income tax rate malaysia

Average Lending Rate Bank Negara Malaysia Schedule Section 140B. Last reviewed - 13 June 2022.

Pdf Asean Tax Malaysia Asd Dsa Academia Edu

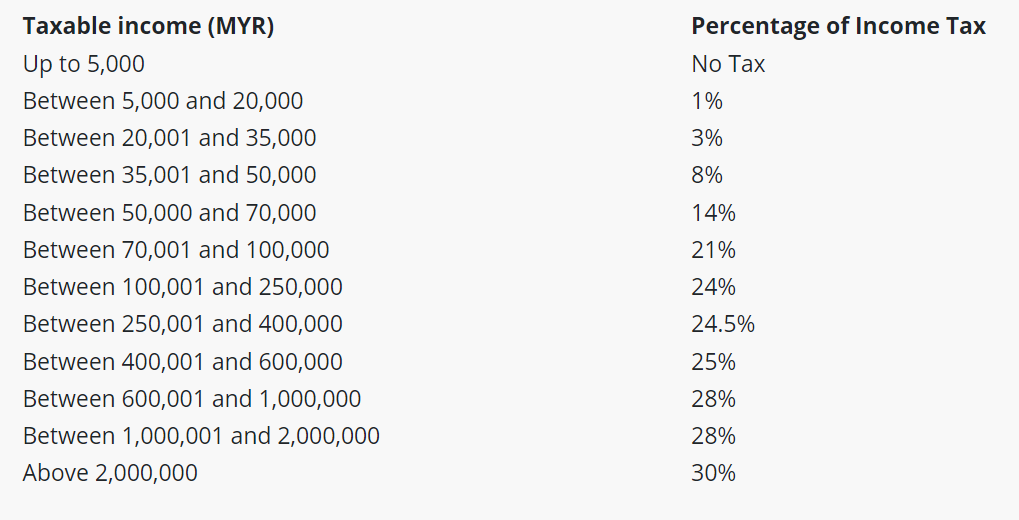

0 Taxable income band MYR.

. A qualified person defined who is a. 2020 income tax rates for residents. You must pay taxes if you earn RM5000 or USD1250.

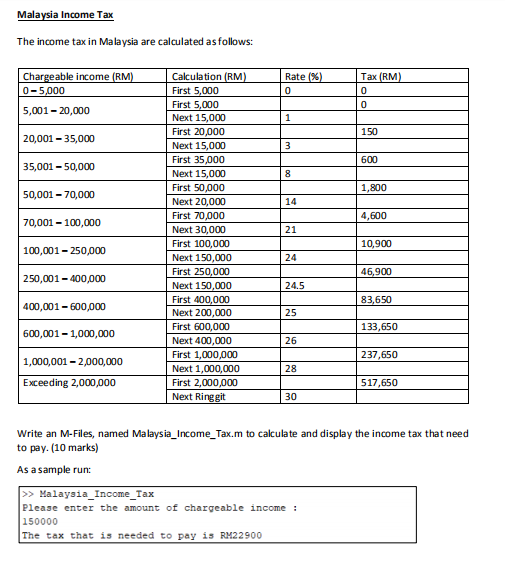

This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. This means that low-income earners are imposed with a lower tax rate compared.

On first RM600000 chargeable income 17. However the blended tax rate is much lower for most residents. To figure your tax rate from this table you first need to identify your taxable income defined as taxable income minus any tax deductions and exemptions.

Taxable income band MYR. A non-resident individual is taxed at a flat rate of 30 on total taxable income. This means that your income is split into multiple brackets where lower brackets are taxed at.

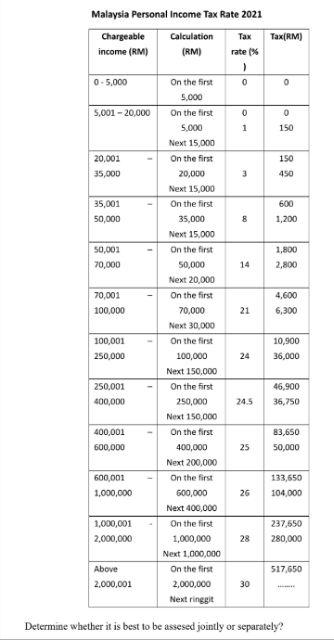

To put this into context if we take the median salary of just over 2000 MYR per month⁴ a resident would pay. The following rates are applicable to resident individual taxpayers for year of assessment YA 2021 and 2022. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated. The standard corporate income tax rate in Malaysia is 24. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967.

Resident company with a paid-up capital of RM 25. Additional rates will be implemented in case of special instances of. So the more taxable income you earn the higher the tax youll be paying.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Malaysia uses a progressive tax system which means that a taxpayers tax rate increases as the income increases. For resident taxpayers the personal income tax system in Malaysia is a progressive tax system.

However if you claimed RM13500 in tax. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040. 0 to 5000 Tax rate.

13 rows Personal income tax rates. This booklet also incorporates in coloured italics the 2023. ITA enforces administration and collection.

Other corporate tax rates include the following. However non-residing individuals have to pay tax at a flat rate of 30. Per LHDNs website these are the tax.

115-97 permanently reduced the 35 CIT rate on resident. Review the latest income tax rates thresholds and personal allowances in Malaysia which are used to calculate salary after tax. Malaysia Income Tax Rates and Personal Allowances.

Your tax rate is calculated based on your taxable income. Corporate - Taxes on corporate income. This will be in effect from 2020.

For both resident and non-resident companies corporate income tax CIT is imposed on income. Taxable income band MYR. Company having gross business income from one or more sources for the relevant year of assessment of not more than RM50 million.

Individual Income Tax In Malaysia For Expats Gpa

Malaysia Personal Income Tax Rate 2022 Take Profit Org

Us New York Implements New Tax Rates Kpmg Global

Free Online Malaysia Corporate Income Tax Calculator For Ya 2020

Solved Malaysia Income Tax The Income Tax In Malaysia Are Chegg Com

What Is The Difference Between The Statutory And Effective Tax Rate

Taxing High Incomes A Comparison Of 41 Countries Tax Foundation

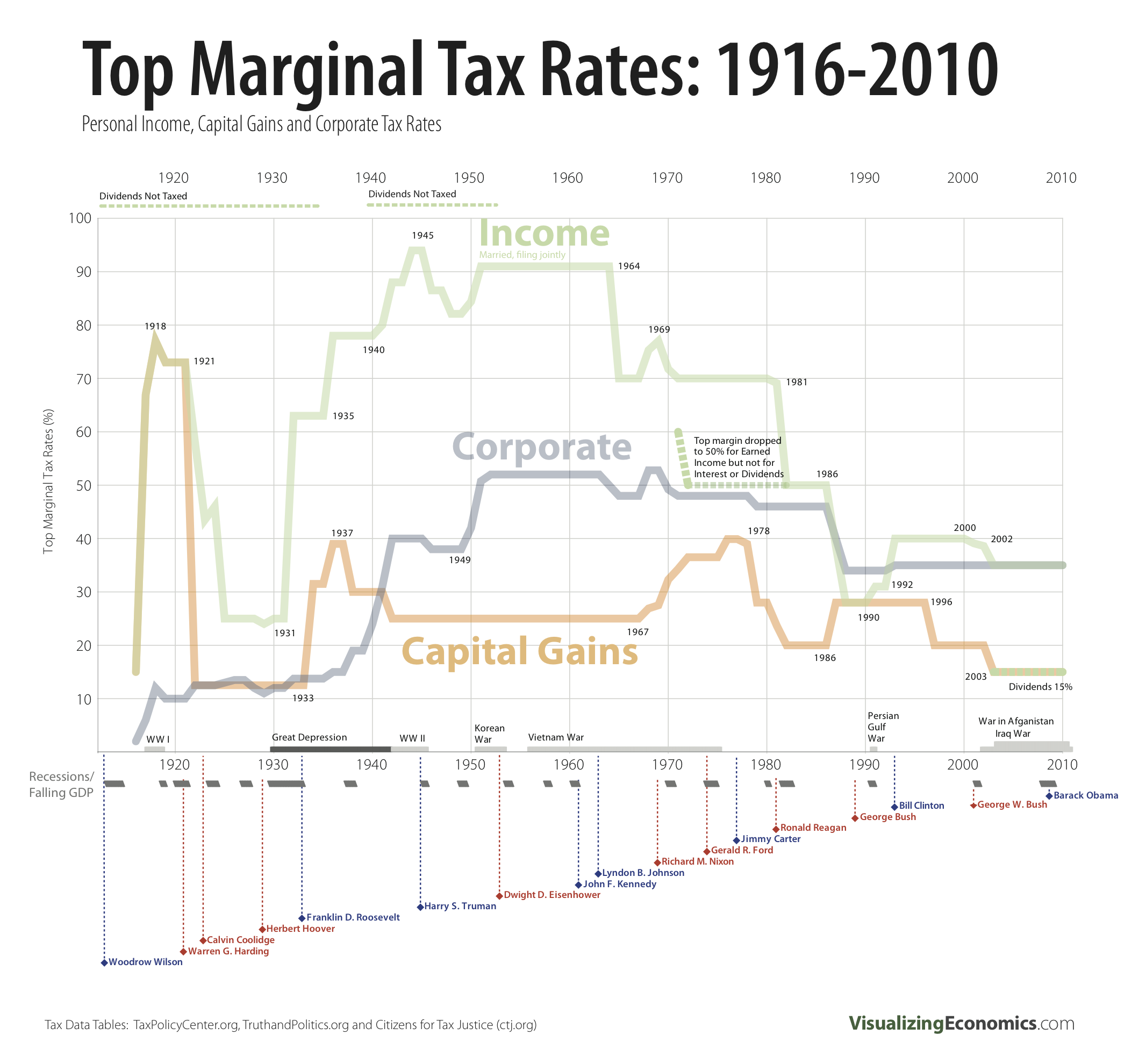

Fluctuations In Top Tax Rates 1910 To Today Sociological Images

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

The State Of The Nation Individual Tax Cuts Still Possible In Budget 2023 Despite Likely Silence On Gst The Edge Markets

13 Ehsan S Family Wants To Submit Lhdn Return Form Chegg Com

Budget 2023 Tax Cuts And Generous Handouts Leave Experts Perplexed

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

Tax Guide For Expats In Malaysia Expatgo

Borang Tp 1 Tax Release Form Dna Hr Capital Sdn Bhd

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More